Benefits

If you're looking for specific benefits sites, see the benefits links page.

GSA requires that you enroll in many of the benefits offered to you within the first 60 days of work. Otherwise, you'll have to wait for Open Season, which typically runs from the Monday of the second full work week in November through the Monday of the second full work week in December.

Submitting benefit forms

New hires

Follow , external,TTS-only, these instructions to make your benefits selections in TTS-only, HR Links. You can email your GSA HR Benefits contact listed in the , external,TTS-only, Benefits & Support Contacts for TTS Employees document if you have any questions.

Note: if you have dependents that you wish to cover, begin by going to HRLinks, click the Life Events tile, and select a New Employee life event. It will give you the option to add dependents.

Current employees

If you are revising benefits due to a change in life event (for example, getting married or having a child), you have from 30 days before the event to 60 days after the event to make changes. Outside of this window, you will need to wait for the annual open enrollment period to adjust your benefits. Some life event changes require documentation, such as a marriage license. You may start the form and return to it once you have the required documentation.

Healthcare plan

Log into HR Links and navigate to the Life Event section:

- Compass (upper right hand corner)

- Navigator

- Self Service

- Benefits

- Life Event

From there, you will be asked to select a life event. You will be walked through the process to upload documents, add beneficiaries (family members on your insurance), and change plans.

Dental and vision plan

You may change your dental and vision plan and beneficiaries by logging into your BENEFEDS account online or by calling 1-877-888-3337.

Benefits contacts

Email the GSA HR Benefits contact listed in the , external,TTS-only, Benefits & Support Contacts for TTS Employees document for questions related to benefits and retirement

For leave policies (including annual, sick, advance leave requests, leave without pay requests, donating leave, parental, and Family Medical Leave Act), please reach out to the Leave Policies contact in the , external,TTS-only, Benefits & Support Contacts for TTS Employees document.

Slack channel for TTS staff to discuss GSA benefits:

Credit union

GSA has a credit union. It is free and easy to join if you're a current employee. Once you join, you're a member for life (even if you leave GSA).

Discounts

Organizations across the United States offer a number of discounts to federal employees. Specific discounts are covered in , external,govexec.com and , external,govloop.com, but some highlights include:

- Members of the military and government employees with verified email addresses are eligible for , external,free digital access to The Washington Post.

- Major cell phone carriers offer a 15% discount on cell plans to all federal employees---just ask!

- Apple offers a discount (~10%) to feds when they buy personal equipment.

- General Assembly offers a discount to federal employees.

Employee Assistance Program

The , external,Employee Assistance Program (EAP) is a free support resource available to all GSA federal employees. The EAP offers sessions with licensed or credentialed counselors on a variety of topics:

- Grief

- Work-related stress

- Drug or alcohol addiction

- Mental health

- Legal issues

- Financial issues

- Emotional well-being

You can receive six free sessions for you or family members living in your household, including college students who are away. EAP counselors can provide referrals for assistance beyond the six sessions, based on your needs, insurance coverage, location, and financial resources.

To access the EAP, you can call them 24/7 at 1-800-222-0364 or 888-262-7848 (TTY). You can also view EAP materials on the , external,EAP website. You'll need to click "Enter Site" and log in or register if it's your first time (the registration code can be found on the TTS-only, GSA InSight page). You can also find more information in the , external,TTS-only, EAP Fact Sheet.

WorkLife4You

The EAP’s , external,WorkLife4You program provides additional support and resources.

Through Worklife4You, you can get assistance with

- Emergency back-up care, for children and adults

- Education and career development

- Health and wellness

The emergency back-up care is available at very low costs - review the , external,TTS-only, Emergency Backup Dependent Care flyer for more details. TTS teammates have shared their experiences with back-up care in the , external,TTS-only, #parents Slack channel.

WorkLife4You programs can be accessed via the EAP phone line: 1-800-222-0364 or 888-262-7848 (TTY). You can also register via the , external,WorkLife4You website. More information - including the registration code - is available on the , external,TTS-only, WorkLife4You Fact Sheet.

EAP supervisor resources

Supervisors can leverage the EAP to help support their team:

- Managing crises

- Identifying if/when someone is in trouble

- Managing change

- Referring your team members to the EAP

- Managing stress

- Effective communication

The , external,TTS-only, EAP Supervisor Toolkit is an additional on-demand leadership resource that helps supervisors with coaching and mentoring. Supervisors can access webinars, leadership presentations, EAP orientations, and training opportunities. The EAP Supervisor Toolkit offers best practices for:

- Encouraging your team to use EAP

- Navigating difficult conversions

- Providing support throughout organizational changes, such as workplace grief

- Team engagement and productivity

To access the EAP, you can call them 24/7 at 1-800-222-0364 or 888-262-7848 (TTY). You can also find more information and online leadership presentations on the , external,EAP website and refer to the , external,TTS-only, EAP Supervisor Guide for additional support.

EAP orientation, wellness sessions, and GSA's point of contact

Throughout the year, you can attend an EAP Orientation as well as free health & wellness sessions. Visit the TTS-only, EAP InSite Page for current dates, times, and links.

The InSite page also lists GSA's EAP program manager, if you want to provide feedback about your experience with the program.

Flexible spending accounts

, external,Flexible spending accounts (FSA) allow you to pay for , external,eligible out-of-pocket health care and dependent care expenses with pre-tax dollars. They cannot be used to pay any type of premium, and you must use all the money in your account by the end of the year or you risk forfeiture of the unused funds. However, there is a grace period. If you have unused funds in your FSA account and incur expenses from January 1 through March 15, you have until April 30 to submit claims against the prior year.

Common reimbursements include gym memberships (with a doctor's note), over-the-counter medication (with a doctor's note), and eyeglasses.

There are three kinds of FSA:

- Health Care Flexible Spending Accounts are used to pay for qualified medical costs and health care expenses not covered by your Federal Employees Health Benefits

- Limited Expense Health Care Flexible Spending Account (LEXHCFSA) is only available to employees who enroll in a FEHB program or under a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA). Expenses are limited to dental and vision care services and products that meet the IRS definition of medical care.

- Dependent Care Flexible Spending Accounts are used to pay for eligible dependent care expenses such as child care for children under age 13 or children who are physically or mentally incapable of self-care. In some cases, they're also used to pay for elder care.

Flexible Spending Accounts run on a calendar year and enrollment into the program is closed on October 1 of each year. New and newly eligible employees who wish to , external,enroll in this program must do so within 60 days of their start date and prior to October 1. If you miss this deadline, you must wait until Open Season (mid-November) to enroll for the following calendar year.

Please note that FSA does not automatically renew each year; you must re-enroll annually.

Insurance

Health

The , external,Federal Employees Health Benefits (FEHB) program offers a wide selection of health plans for eligible employees and their eligible family members.

Eligible employees may choose from:

- Fee-for-Service plans and their Preferred Provider Organizations (PPOs);

- Health Maintenance Organizations (HMOs) for those who live within the geographic area serviced by the plan; and

- Consumer-Drive and High-Deductible health plans that offer catastrophic risk protection with higher deductibles, health savings and reimbursement accounts, and lower premiums.

The Office of Personnel Management lists the , external,plans available in each state.

New employees, employees who move outside of the area covered by their plan, and employees who have certain life qualifying events have 60 days to enroll, modify, change, or cancel their plans. If you do not fit into one of those categories, you can change, modify, cancel, or enroll during Open Season. Open Season typically runs from the Monday of the second full workweek in November through the Monday of the second full workweek in December. OPM provides a , external,detailed FAQ on eligibility for federal employees.

To enroll or re-enroll in FEHB, elect not to enroll in FEHB, change your enrollment, cancel your enrollment, or suspend your enrollment you must do so in HR Links by taking the following steps:

-

Select the Benefits Library icon

-

Click on the Forms Center

-

Select "Health Benefits Election Form"

- a list of event codes can be found by going to the side bar and clicking the second to last bookmark titled "Tables of Permissible Changes..."

-

Once you click "Submit" the documents get sent to the cpc benefits team where they can review and process these actions.

The earliest date your insurance can be effective is two weeks after your start date, assuming you send your documents in immediately. You get access to , external,Employee Express, where you can check the status of your health insurance, after your first paycheck. You can also call your providers directly to confirm enrollment. Questions? Contact the , external,TTS-only, FAS Benefits Specialist who corresponds to your last name.

Dental

To qualify for , external,dental insurance, you must sign up within 60 days of joining TTS, after a qualifying life event, or during Open Season. Some health insurance plans come with dental coverage, so you may not need dental insurance. Read your plan booklet to see what's covered. You can sign up for dental coverage on , external,Benefeds.

Note: To create your account for Benefeds, you may need to contact their customer service via the phone number listed on their , external,Contact page.

Vision

To qualify for , external,vision insurance, you must sign up within 60 days of joining TTS, after a qualifying life event, or during Open Season. Some health insurance plans come with vision coverage, so you may not need vision insurance. Read your plan booklet to see what's covered. You can sign up for vision coverage on , external,Benefeds.

If you have an eye appointment but have yet to receive your card(s), you can look up your Vision Care subscriber ID online. To do so, log on to , external,Benefeds.

Note: To create your account for Benefeds, you may need to contact their customer service via the phone number listed on their , external,Contact page.

Filing an insurance complaint

If you're having difficulty resolving an issue or getting clarification from your insurer, follow these steps:

-

Email , external,FEHB@opm.gov and make sure to include:

- Name of the insurer

- Issue that you need resolved

- What outcome you would like

- A huge thanks to the team that wrangles these complaints

-

They forward the issue to the company and use the complaint to see if there's a pattern of abuse by the company

- The company fixes the issue at this point

-

If you do not hear back within a reasonable timeframe, follow up with FEHB@opm.gov

Leave

Please use TTS-only, HR Links to request sick leave and annual leave. For any leave-related questions, please contact , external,cpc.benefits-retirement@gsa.gov.

For more information on Leave, including sick, funeral, unpaid, parental, advanced, and religious, please reference the Leave page.

Lunch and break periods

You can take a 30-minute or one-hour lunch break. Lunch breaks are unpaid, so you need to make sure you work eight hours per day. For example, if you come in at 8:00 a.m. and take a 30-minute lunch, you’d work til 4:30 p.m. If you took an hour lunch break, you’d work til 5:00 p.m.

You get two 15-minute breaks per day. These breaks do not extend the work day, since they’re paid. If you came in through the Peace Corps, you may have different options. Contact your bargaining unit or union directly for details.

Paychecks

We are paid biweekly. You’ll receive your first paycheck about three weeks after your start date. This is because every TTS employee starts work at the beginning of a pay period. It takes a week after the end of a pay period for a direct deposit to be made. See the GSA Payroll Calendar to determine future pay cycles.

Please direct questions to the payroll help desk: 1-844-303-6515 or , external,email them.

To see your recent pay stubs:

- Sign into , external,Employee Express. If you don't have access yet, email , external,kc-payroll.finance@gsa.gov to request a copy. They’ll send it to you in a password-locked zip file.

- Click the "View Your Earnings and Leave Statement" link in the middle of the page.

- Choose the appropriate pay period in the drop-down menu.

For help interpreting the many boxes on your paystub, see , external,How to Read Your Leave and Earnings Statement. You can also watch , external,TTS-only, the recording of 'A Beginner's Guide to Your Earnings and Leave Statement,' a session that a TTS teammate offered.

Note that the gross income in your paycheck is a little less than your annual income / 26 paychecks. The difference lies in the way the federal government calculates hourly rates from annual salary. The federal government divides the annual salary by 2087 hours rather than 2080 hours (26 pay periods x 80 hours) to determine hourly rates.

This is because about every 11 years or so there are 27 pay periods rather than 26 pay periods (2015 was such a year for GSA payrolled employees). Here is an article that explains this: , external,Why your paychecks don't always add up.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a government program that offers forgiveness of federal student loans under certain conditions. Further information on the program and whether you qualify for PSLF can be found on , external,the PSLF webpage.

Please Note: The Department of Education recommends that you submit the PSLF form annually or when you change employers. It will make it much easier once you are ready to apply for forgiveness after 10 years of employment in public service! If you do not submit the PSLF form with your employment certification annually, then at the time you apply for forgiveness, you will be required to submit employment certification for each employer you worked for while making the required 120 qualifying monthly payments.

As a GSA employee, you are eligible for PSLF (assuming you satisfy the other conditions).

To fill out your PSLF application and obtain employer verification:

-

Download the application PDF from the , external,PSLF application page

-

Fill out your Section 1 of the application with your personal information.

-

Check the appropriate box in Section 2 depending on whether you think you currently qualify for PSLF or not.

-

Add your signature to the bottom of page 1. IMPORTANT: You can sign the document in pen/ink or using a digital signature. But if you use a digital signature, it must be hand-drawn. Adobe Reader provides the ability , external,to sign documents with hand-drawn signatures.

-

Enter the following information in Section 3:

- Employer Name: General Services Administration

- Federal Employer Identification Number (FEIN): 44-0553234

- Employer Address: 1800 F St. NW, Washington, D.C. 20405

- Employer Website: www.gsa.gov

- Employment Begin Date: Whenever your posting officially began. You can

find this date in TTS-only, HRLinks under

Employee Personal Info -> View/Update Personal Info -> Personal Information -> Employee Information. - Employment End Date: Check "Still Employed"

- Employment Status: Check "Full-Time"

- Hours Per Week (Average): 40

- Is your employer a governmental organization?: Check "Yes"

-

Do not fill out Section 4. This section will be completed by a GSA HR representative as detailed below.

-

Save your updated PDF.

-

Login to TTS-only, DocuSign.

-

Click "Start" and then "Send an Envelope".

-

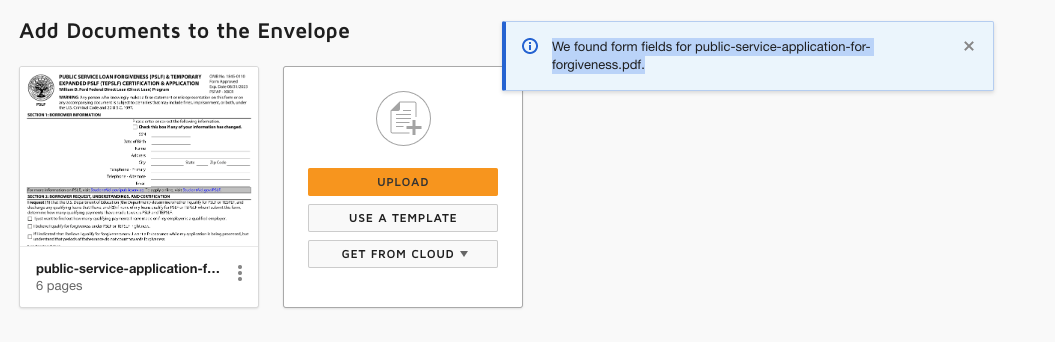

Under

Add Documents to the Envelope, click the "Upload" button and select your partially completed PSLF application. Once the document is uploaded, you should a pop-up message like "We found form fields for public-service-application-for-forgiveness.pdf."

-

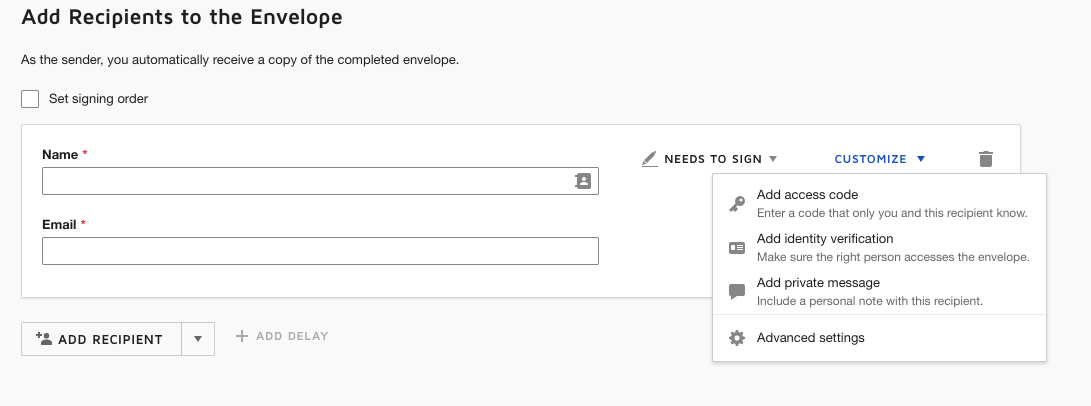

Under

Add Recipients to the Envelope, add our , external,TTS-only, PSLF point of contact as the recipient of the envelope -

On the recipient box for our , external,TTS-only, PSLF point of contact, click

Customize -> Advanced Settings

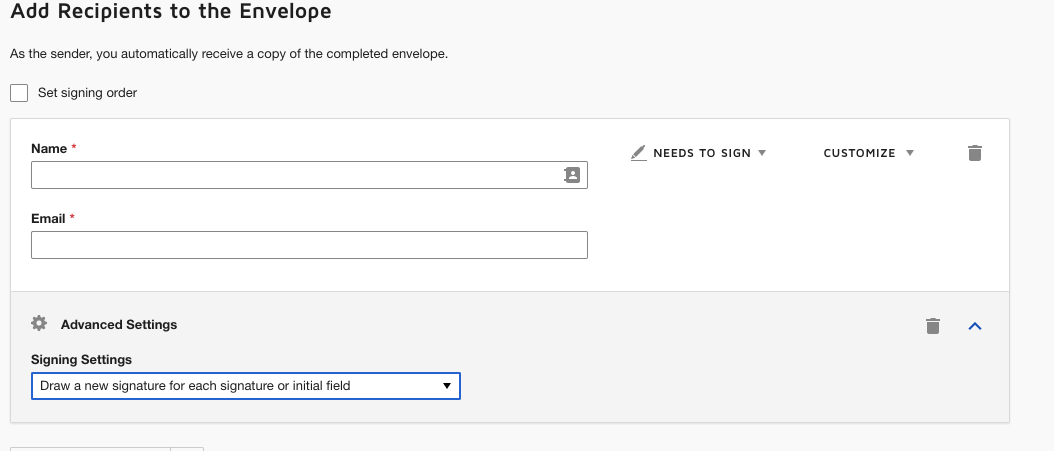

-

For the "Signing settings" in the "Advanced Settings" area, choose "Draw a new signature for each signature or initial field"

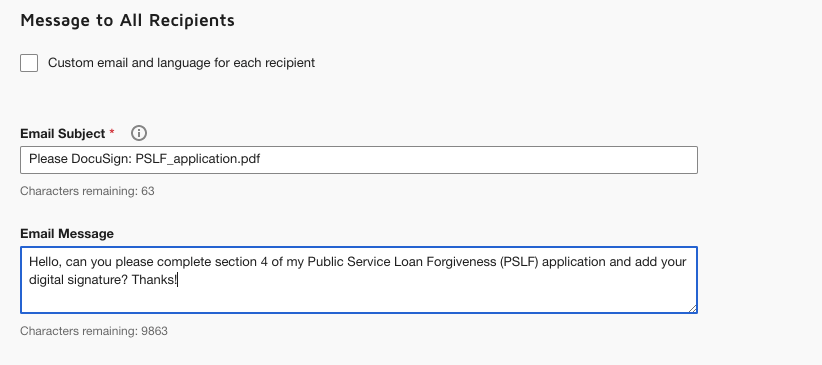

-

Optionally, customize the email message. Suggested message content: "Hello, can you please complete section 4 of my Public Service Loan Forgiveness (PSLF) application and add your digital signature? Thanks!".

-

Click "Next" at the bottom right corner of the screen.

-

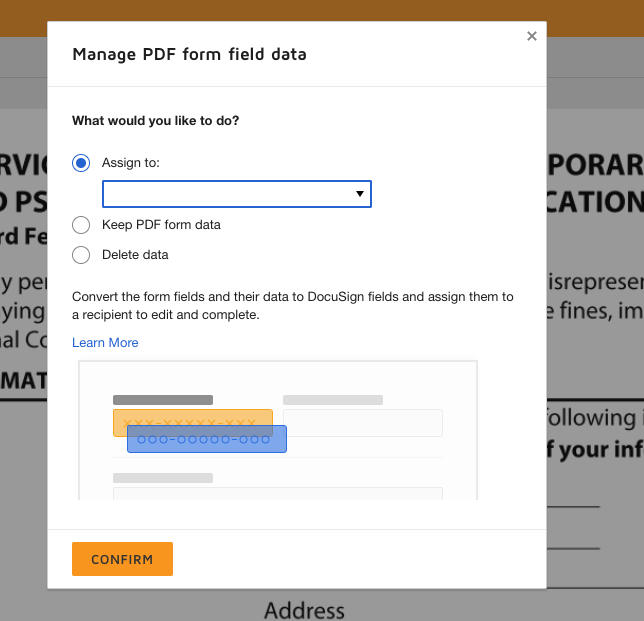

On the next page, a "Manage PDF form field data" pop-up form will appear. Select the "Assign to:" option and then select the name of our , external,TTS-only, PSLF point of contact from the drop-down menu. Then click the "Confirm" button in the pop-up.

-

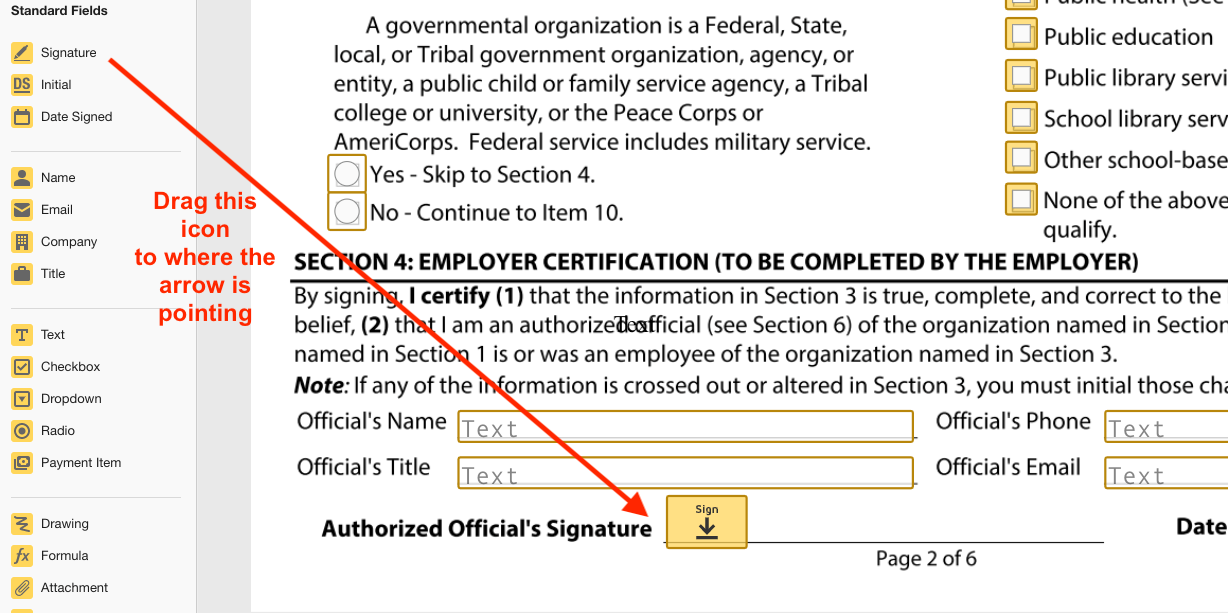

Scroll to Section 4 of the document and drag the "Signature" field option from the left sidebar next to the line that says "Authorized Official's Signature".

-

Click the "Send" button at the bottom right corner of the screen to send your document for signing.

-

Once you receive an email confirming that your document has been signed, download the signed document.

-

Follow the guidance on the , external,Student Aid PSLF webpage to submit your application.

Retirement

FERS (Federal Employees Retirement System)

The Federal Employees Retirement System (FERS) is the retirement plan that all employees pay into during their federal employment. A percentage of each paycheck is withheld by GSA and put into FERS.

Employees must have at least 5 years of , external,creditable service to be eligible for FERS payments upon retirement.

If you leave government before becoming eligible for FERS retirement, you can request that your contributions be returned in a lump sum payment: see leaving TTS for more information.

If you served as an AmeriCorps VISTA volunteer, a Peace Corps Volunteer, and/or in the military, you may be eligible to “buy back” your service. “Buying back” your military/volunteer service allows the amount of time you served to be applied toward your FERS retirement calculations.

As an example, if you served in the Peace Corps for 2 years and buy back your service, that amount of time would be considered creditable service and would increase your “length of service” , external,FERS payment calculation.

To buy back your Peace Corps volunteer service, you will need to obtain a copy

of your , external,Peace Corps Certification of Service, complete the form , external,SF-3108, and

submit these documents to the , external,TTS-only, HR specialist assigned to you.

Once the HR specialist has received your documents, they will complete the rest

of the SF-310 form and return it for you to sign. When you return the

signed SF-3108 form to HR, they will send this form to OPM.

OPM will compute the amount owed based on what you would have paid for

retirement contributions including accrued interest and will mail you

a “Civil Service Deposit Account Statement” to your home address.

Make sure to note the claim number (starting with CSD -) on the form,

you will need this for any future correspondence with OPM.

The payment can be made by check or by credit card at , external,pay.gov.

After you make the payment, you will need to contact OPM to obtain

a “Paid in full statement” , which you will need to submit to , external,TTS-only, GSA HR.

They will upload the Paid in Full statement to your eOPF.

Then, they will need to update your Service Computation Date (SCD) for Retirement

in HRLinks and on your SF-50 to show the additional time from your Peace Corps service.

The calculations for FERS retirement can be complex, and there is paperwork to complete. We recommend carefully reviewing all information and talking to HR personnel as needed. Visit the following websites, Slack channels, and email the GSA HR Benefits contact listed in the , external,TTS-only, Benefits & Support Contacts for TTS Employees document.

- , external,AmeriCorps VISTA

- , external,Military service and , external,TTS-only, #vets

- , external,Peace Corps and , external,TTS-only, #rpcvs

TSP (Thrift Savings Plan)

Employees at TTS are eligible to participate in the , external,Thrift Savings Plan (TSP). For more information on TSP, please refer to the TTS-only, TSP Insite page.

You will update TSP directly in HR Links by following this , external,TTS-only, visual guide or these steps:

- After you sign into HR Links, click "Benefits Summary"

- Click on the TSP tile/row to view and edit your contribution amounts

- Click Save

If you had been contributing to a 401k, 403b, or a similar plan at a previous employer this year, your total contribution for all similar plans cannot be higher than the , external,annual limit.

You can roll over money from eligible retirement plans to your TSP account. TSP offers a rollover concierge service and a self-service option. Visit the , external,TSP Move Money page for details.

There are numerous free TSP webinars available: visit the , external,TSP Online Learning page to view descriptions and dates.

Training

TTS team members are eligible for many professional development and training opportunities. For more information, see attending conferences.

Transit subsidies

See the transit benefit page.

Return to the top of the page ^